Ministers to hand more than £1bn to Lower Thames Crossing in spending deal

- Safer Highways

- Jun 9, 2025

- 3 min read

Ministers to hand more than £1bn to Lower Thames Crossing in spending deal

Taxpayer backing to be unveiled by Rachel Reeves will pave way for private fundraising

Ministers are set to allocate more than £1bn of public funding for the Lower Thames Crossing as part of next week’s spending review, according to government officials.

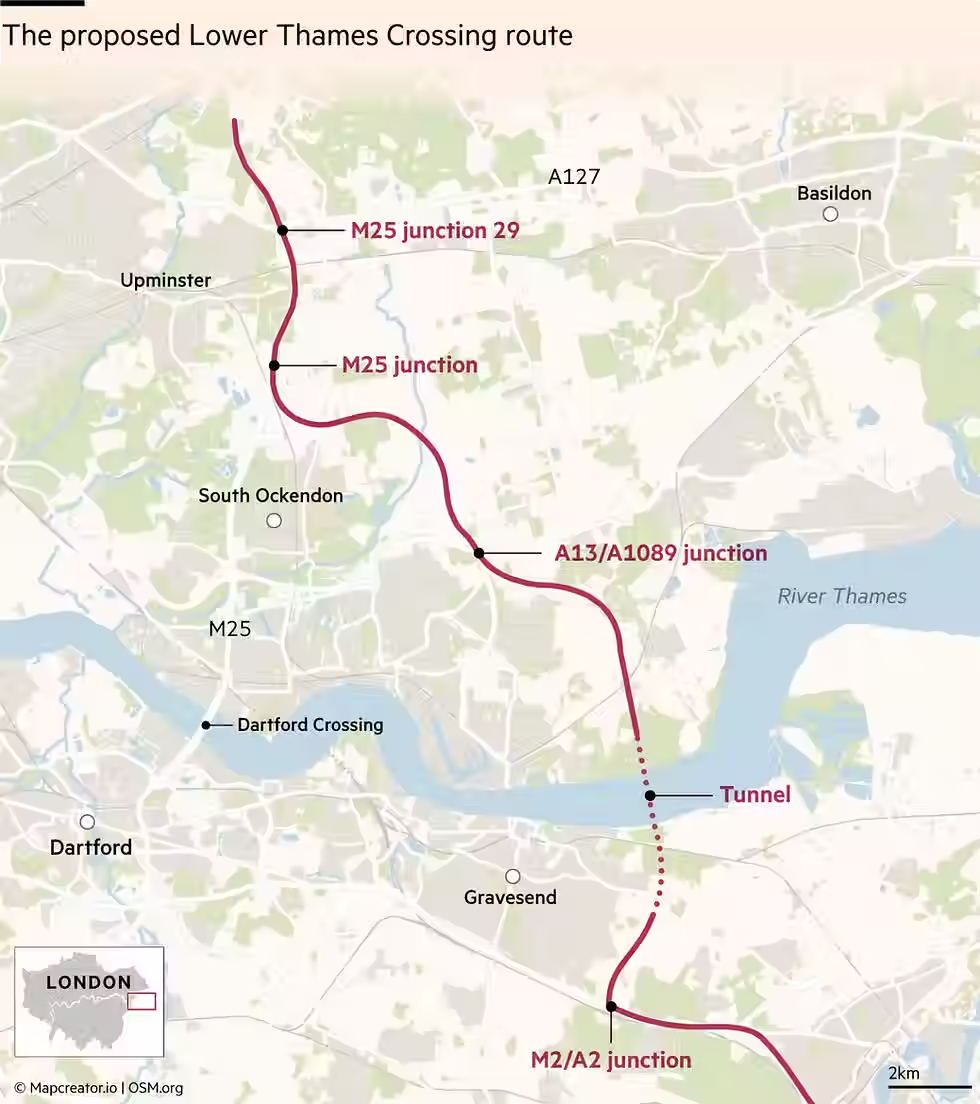

The sum, which is set to be lower than the £2bn project operators initially wanted, is needed to unlock private investment into the £10bn road tunnel that will link Kent and Essex. National Highways, the government body behind the project, previously estimated that £1.9bn was required to secure £6.3bn of private capital, using a model favoured by the Treasury that would allow investors to recoup their money through driver tolls.

Chancellor Rachel Reeves would allocate taxpayer support for the project as part of the spending review, the people said. Officials expect the crossing to be financed and run by private investors under the “regulatory asset based” or RAB model. The model has been used by other big infrastructure projects such as the Thames Tideway sewage tunnel.

National Highways previously said this approach would cost about £200mn more than if the state funded the entirety of the project. Construction on the 14-mile road and tunnel is expected to start in the next 12 months, after no appeals were received ahead of a deadline to legally challenge the project’s planning consent. The project is a test of the government’s ambitions to unblock large infrastructure work. National Highways has spent more than £1.2bn on the crossing even before building work has started, while its planning document runs to more than 300,000 pages.

The funding for the Lower Thames Crossing will be part of a broader announcement by Reeves of up to £113bn in capital and infrastructure projects, as she seeks to convince the public that her government has a plan to boost economic growth and improve public services. Reeves changed the government’s fiscal rules at her October Budget to increase the amount she could borrow to fund capital investment.

At the same time, she is set to announce sharp cuts to government spending across some unprotected departments as she seeks to rein in costs and balance the budget. The Treasury declined to comment. National Highways did not immediately comment. More than £1.2bn has already been spent on the project since it was first agreed in 2017, including on legal fees, consultations, land purchases and a community woodland.

In March, the government gave planning permission for the crossing, which Reeves has said is “infrastructure our country desperately needs”. No legal challenges to the permission were filed before a May 6 deadline. The absence of objections has surprised experts, who are used to UK infrastructure projects being bogged down in court proceedings. Mustafa Latif-Aramesh, partner at law firm TLT, said the lack of a court claim against the controversial road project suggested that the government’s proposed planning reforms were “having the desired effect”.

“The strong endorsement by the Department for Transport and the government’s strong signal it supports projects like this, which support growth, will have dissuaded challenges too,” he added. A judicial review can add between £66mn and £121mn to a scheme and delay construction by a year or 18 months, a government review found last year. The government’s infrastructure and planning bill, currently winding its way through parliament, will make it harder for third parties to challenge development projects through the current judicial review process. However, there are concerns that it will weaken environmental protections as developers will be allowed to pay into a nature restoration levy scheme in an attempt to mitigate any environmental harm elsewhere.

Article first appeared: https://www.ft.com/content/e138b193-fc1a-421f-a080-5d32334afd26

Author : Gill Plimmer and Anna Gross

Please note this is not an Insight Article

Comments